Category: dubai

-

VAT Services in Dubai

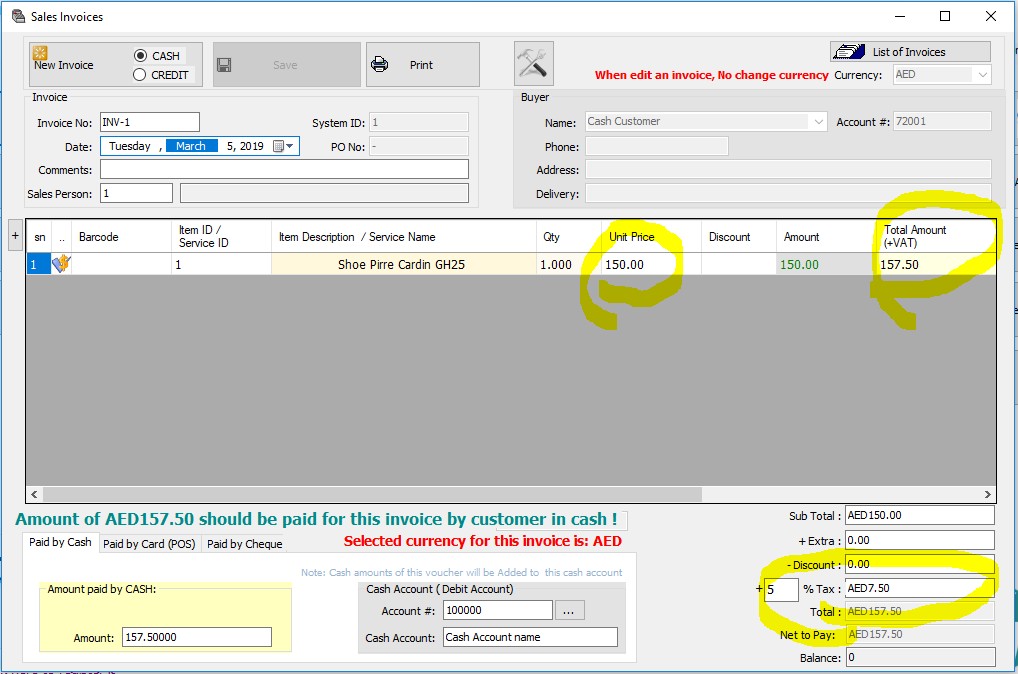

For any business and shop in United Arab Emirates, a valid and legal vat report is a very important challenge to avoid VAT penalties of DED. in Dubai, any sales invoice will charges with 5% tax. but this tax is free for tourists and refundable in airport at departure time. so it is a must…

-

Vat Compliant Accounting Software in UAE

VAT (Value Added Tax) has been activated since 2018 in United Arab Emirates. before there was no tax on businesses but it is running now. regard to this new rule, iGreen software has been updated with easy to use VAT option. so that you can adjust VAT in it and easily print invoices with VAT. …

-

Custom software

Some of businesses in Dubai, and other cities in United Arab Emirates need special window applications for their account and sales departments. It can include special formulas of profit calculation or warehouse counting or everything else that you could not find it in current existing software in the software shops in Dubai. but don’t worry,…

-

TRAVEL AGENCY SOFTWARE

Dubai city has a high volume of flights, with over 400 per day from its airports. For businesses with the title “Travel Agency”, it is mandatory to have an accounting software with travel agency modules to manage financial transactions and cash flow effectively. This includes a special version of the application to enter vouchers for…