VAT (Value Added Tax) has been activated since 2018 in United Arab Emirates. before there was no tax on businesses but it is running now. regard to this new rule, iGreen software has been updated with easy to use VAT option. so that you can adjust VAT in it and easily print invoices with VAT.

At the time of invoicing, you can enter amount of item, so iGreen will calculate amount of item price + vat or you can enter total amount of item + vat and iGreen will calculate price of item without VAT.. This is easy to save time

How to setup VAT in iGreen software

To active VAT option for invoicing and purchase entry, you should setup amount or tax percent per sales and your UAE TRN vat number in setting form as below instruction.

You should get your TRN number from TAX department in Dubai economic organization.

Note: At this time (2020), VAT percent in All cities of United Arab Emirates is 5% .

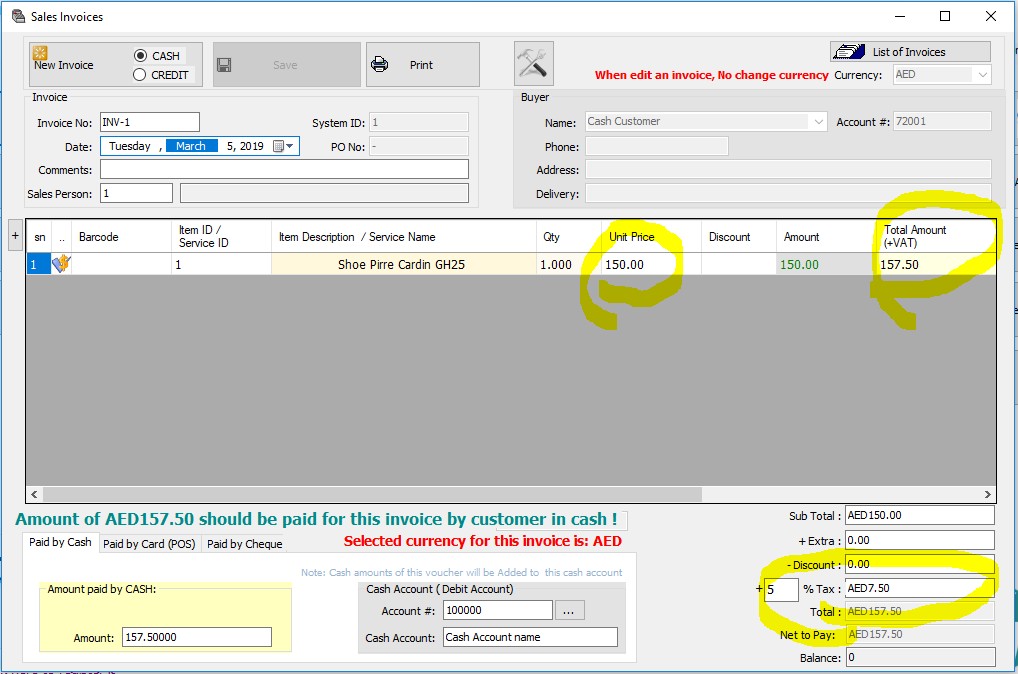

After save setting of VAT, you can issue sales invoices with VAT. iGreen will calculate 5% of sales amount as VAT and it will be added to total amount of sales invoice.

Example of invoicing with VAT in Dubai

As you see, we highlighted VAT in this sale invoice. price of item is only 150 AED and 5% VAT is 7.5 AED so that total amount of this invoice is: 157.5 AED

And here is printed version of this invoice in A4 paper size.

when you print this invoice, you can export it to EXCEL, PDF and MS Word also easy by one click.

This below file is PDF file of above example, please click on it and download it.

Leave a Reply

You must be logged in to post a comment.