When you listen term “computerized software”, maybe you think it is a non-useful term and any software means computerized but, vise versa:

there are there types of software:

- Normal (without any smart modules) like notepad software

- Computerized software that it will calculate some of works and it will do it automatically without need any actions from users

- Full Smart that it will do more than 90% of works automatically and in a smart ways like robots programs

computerized accounting vs normal accounting software

An accounting software could be fully under control of user with manual functions or with automatic modules and smart functions.

for example if an accounting software will generated and post double entry of invoices automatically same time when user enter items of invoices, then it is a computerized accounting software. power of computerized is related of how many of functions will do by accounting program automatically.

some of accounting software will do low quantity of financial functions but some of other software will do most of financial calculation.

Computerized structure if iGreen accounting

In iGreen accounting, we are tried to put the most functions and modules in automatic status. for example when you open an invoice and enter sold items, financial functions that will by iGreen accounting will be:

- Journal Double entry

- A standard sales journal will be post

- Account balance of buyer (AR of customer)

- Account of customer will be debit as amount of invoice

- Cash amount of cashier

- Cash account will be credit as amount of received cash from customer in cash sales

- Amounts of sold items in stores

- Amount / quantity if sold items will be less from item inventory

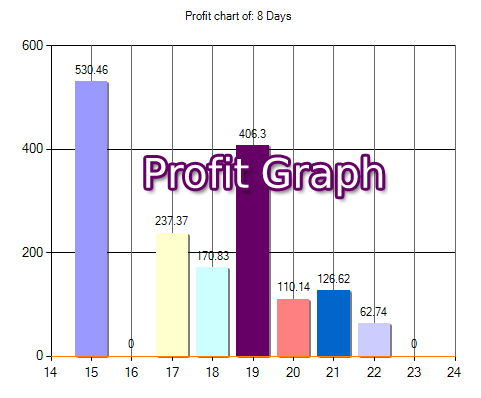

- Profit calculation of sold items

- Profit and loss statement will be updated

- Cheques in banking

- If any received cheque, it will be added to cheque book inventory

- POS account of card payment by customer

- If any card payment, its amount will be added to POS bank account

- VAT calculation and its voucher

- It will calculate 5% of sold amount and it will be added to VAT account

- Salesperson commission

- It will calculate commission of salesperson regard to sold items and salesperson commission percentage

More link: Download and use iGreen accounting software, Click here

You must be logged in to post a comment.