Category: VAT

-

Original documents archives in iGreen accounting

Keeping scan of documents and original receipts beside invoices and vouchers is very important. for example when you buy an item from a personal seller, you need to keep a copy of its passport or when you enter an exported sales invoice, you need to keep its export and shipping documents. in iGreen software, you…

-

Adjusting VAT number

VAT number (or TRN number in UAE) is important to be printed in receipts, invoices and bills. as tax authority departments will fines you if there is no tax number on header of your prints. You can put your Tax number (TRN number) in iGreen accounting software in on click only. please watch below video…

-

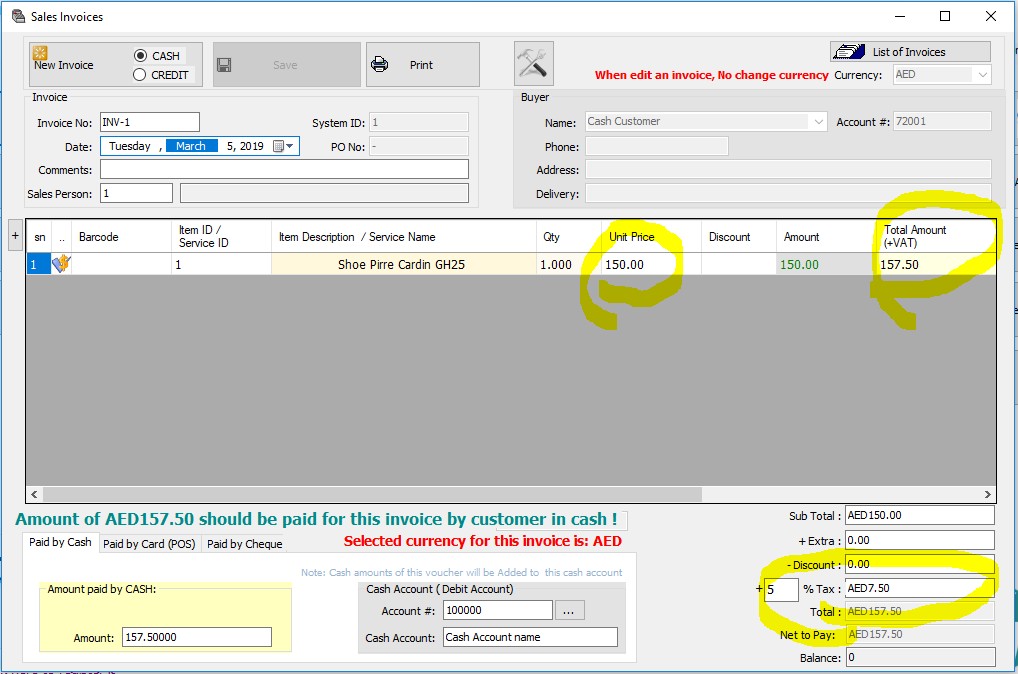

Vat Compliant Accounting Software in UAE

VAT (Value Added Tax) has been activated since 2018 in United Arab Emirates. before there was no tax on businesses but it is running now. regard to this new rule, iGreen software has been updated with easy to use VAT option. so that you can adjust VAT in it and easily print invoices with VAT. …

-

FTA Audit File

FTA audit file is very important in any accounting software to send tax value to UAE tax portal automatically. If you have a business in Dubai, Abu Dhabi, Sharjah, Ras Al Khaimah and Al Ain, so that you can send your business’s tax declare by iGreen accounting software to online tax portal of United Arab…

-

VAT Report of Sales

iGreen accounting is 100% compliant with UAE VAT rules. It prints your TRN number (Your Tax Number in United Arab Emirates) for economic department of Dubai. VAT in UAE is 5% of sales gross amount. In setting form inside iGreen software, you should enter and save VAT number, and then it appears in prints of…